WaterNeuron Explained

Over the last few weeks, WaterNeuron has been a recurring topic on the forum, many core questions about protocol mechanisms have arisen. We felt that these new questions needed to be addressed in order to clear up a few common misconceptions.

The IC has a liquidity problem

Among the top programmable chains, we are the only one with such low on-chain DeFi TVL, despite a FDV in the same ballpark:

We believe the low DeFI TVL to be a downstream effect of the following:

- Non-EVM architecture: if your chain is EVM, projects can come, fork a protocol and re-launch it or you can make a deal with an already existing protocol to redeploy. You can also tap into a wealth of already existing EVM libraries for multi-sig, DAO, DEX, Borrow/Lending, MarketPlace. On ICP everything has to be written from scratch, and as such project cannot just relaunch or leverage already existing libraries.

- Non-synchronous block: complex multi-step DeFi actions like flash loans or arbitrage are hard as you cannot chain them all in one block.

- Thin Post-Genisis Ecosystem: Most ecosystem projects funded by the initial beacon funds grants are not on the IC, while none of the DeFi projects listed are still around. Were this not the case we could have hit the ground running with many DeFi opportunities for people to deposit their ICP into, from the launch Messari report

- Proof-of-Stake: on other chains validators expose their rewards, as the more they stake the more yield they make. Validators on the IC receive a fixed XDR amount and not an amount relative to ICP staked, which makes it near impossible to create a tokenized version of the staking yield.

- Locked staked tokens: ICP locked in a neuron cannot be transferred or used as a collateral. On every other chain listed staked tokens can be used as collateral on borrow/lending protocols.

- Locking time: un-staking on the IC takes longer than on any other chain, leaving a lot of capital essentially frozen

Are ICP users different from other chains?

We often hear IC users are peculiar therefore what worked over there might not work over here. This is wrong. ICP users yield an appetite that matches what we can see on other general programmable L1. More than 40% of our FDV is currently staked, comparable to every other L1.

Why is this high demand for yield not translated into a higher DeFi TVL?

- NNS was the only protocol with yield (2021-2024). The lack of projects coupled with staking happening at a governance level rather than validators means regular end users locked their tokens on the NNS with no other option available.

- Capital is immobile. Neurons cannot be used as collateral, cannot be sold on the second market. Once your ICP is locked it essentially drops out of the on-chain economy.

⇒ The IC looks like an European saver economy, where the population keep their savings in bank accounts (NNS) rather than use them in the stock market (DeFi).

(Ethereum is extremely strong in DeFi and Sui so low because their FDV is three times their market cap and the difference is both vesting and staked at the same time)

How do we increase DeFi TVL?

The first step out of this deadlock is liquid staking. Every chain that went from high staking TVL to high DeFi TVL used LST to free locked capital while preserving yield.

Today less than 1% of the staked ICP is liquid versus 10% on Near and Solana, and nearly 30% on Ethereum. By motivating users to stake we have more available liquid capital to deploy on borrow/lending or liquidity pools.

(Once again keep Sui and Aptos out of the equation as a large part of their staked TVL is in fact investor vesting and not organic)

Why should non-DeFi projects care about the on-chain economy?

Even if your dapp has no use of DeFi whatsoever (OpenChat, DecideAI, Dragginz). One day you will need to sell tokens, that day you will need deep liquidity pools, which we currently lack.

nICP Yield

On other chains the liquid staking playbook is simple, you spin up validators, stake a lot of tokens, and tokenize them. Allowing people to stake on your validators against a cut of their profit. On the IC the path goes through governance instead of validators. By staking nICP you gain yield and liquidity, while giving up your VP to WTN stakers.

nICP stakers get the boosted yield until the TVL reaches 21M ICP, at which point the WTN airdrop is unlocked. At 21M ICP TVL liquidity should be deep enough to allow large players to move in and out of position easily and disregard the 10% fee taken by the DAO.

- WaterNeuron has 2.3M ICP staked, which represent 68% of all the ICP in DeFi.

- nICP is the largest community owned token pool on ICPSwap.

- Current pool depth: you can sell 20k nICP with less than 2% slippage.

WTN Voting Power

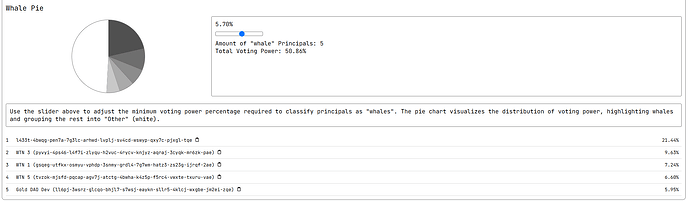

Today the IC’s governance is heavily concentrated:

- ~25% of all the VP sits with DFINITY

- ~6% is controlled by a single whale

Two entities have enough VP for 1/3rd of the VP, even before following. Relying on institutions or wealthy individuals to steer the network is a decentralisation risk. We have seen the effects of concentration on other chains:

- On Bitcoin, the top two mining pool represents 60% of the Bitcoin hashrate.

- On Ethereum, the top two MEV-Boost represent >80% of the blocks.

Unless we work to distribute the VP at the NNS level, the IC is going in the same direction. WaterNeuron’s goal is to put more seats at the governance table.

What do we do from here?

As WaterNeuron takes a larger place in the world of ICP we believe two essential steps need to be taken:

- Increase the WTN Nakamoto coefficient. Currently standing at 5, DAO members are working to make sure this number goes up in time.

- Give more utility to nICP. Borrow/Lending is the next DeFi frontier on the IC. It enables two use cases:

- Looping ICP exposure. Deposit nICP, borrow ICP, stake into nICP, deposit nICP, repeat. Deeper ICP demand and opportunity to leverage ICP.

- Borrowing stablecoin. You deposit LST and borrow stabelcoins. Users can then keep exposure to ICP while freeing cash for real word spending.

To get involved in the WaterNeuron community, feel free to join the Telegram group.

You can find every data source used for this article in the nICP spreadsheet under the tab Pools.