Hello colleagues,

I’d like to introduce you to a project we’ve been working on over the past few months.

In our view, the ICP ecosystem still faces a liquidity gap. One of the main reasons is the lack of reliable statistical data, which makes it difficult to build and manage portfolios effectively. Despite all the advantages of ICP — fast transactions and low fees — the overall liquidity in the network remains insufficient.

We believe one way to attract more capital is by offering users the possibility of achieving potentially higher APY. That is the mission we started this project with.

How are we approaching this?

-

First, we began collecting real data on the base token from liquidity pools that have a reasonable amount of liquidity.

-

We are experimenting with algorithms for automatically reallocating liquidity between pools and providers (smart rebalance).

-

We are also exploring the possibility of automated portfolio management and rebalancing according to market trends.

Currently, we are providing liquidity to pools and taking hourly snapshots of pool balances. These data points help us decide when and where to move liquidity in order to maximize potential yield.

Security is a priority, even at this stage.

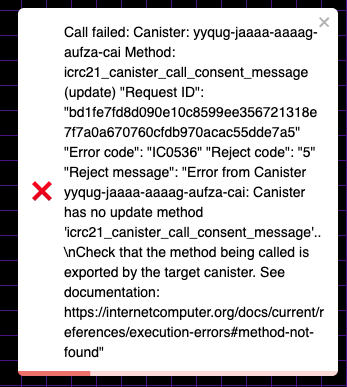

Every event is logged within the canister. On the strategy and portfolio pages, users can track all actions — deposits, swaps, withdrawals, and movements of funds. This ensures transparency, easier debugging, and validation in case of even the smallest errors.

For user convenience, we’ve integrated the main wallets in the ecosystem and implemented swaps with the best available quotes (we currently compare ICPSwap and KongSwap). In the near future, we plan to move away from the base token limitation, allowing users to provide liquidity more flexibly.

We’ve prepared detailed documentation, which we encourage you to review to better understand the foundations of the project. Most of the math happens in the code, and it doesn’t always make sense to surface it directly in the interface:

Documentation

Our production canisters are live, and we’re now filling them with data and strategies. We don’t plan to reinstall canisters, and at this stage we already invite you to try adding test liquidity. We’d be very grateful for any constructive feedback:

Live App

What’s next?

This is only the first step. To make the product fully functional, there’s still a lot of work ahead:

-

Expand the statistical dataset.

-

Integrate with lending protocols and explore APY opportunities beyond liquidity pools.

-

Offer more sophisticated strategies (ideally converging toward one highly optimized strategy with maximum liquidity).

-

Provide users the option to deploy their own controller canister, giving them full security and control (e.g., approving updates, deposits, and withdrawals).

-

Enhance the smart rebalance algorithm with AI-driven factors.

-

Release a product token and design tokenomics that includes burning mechanisms tied to user activity.

We truly hope this project will bring value to the ICP community, and we look forward to your feedback.