But it’s 100% true. Your actions were the catalyst for what we have today.

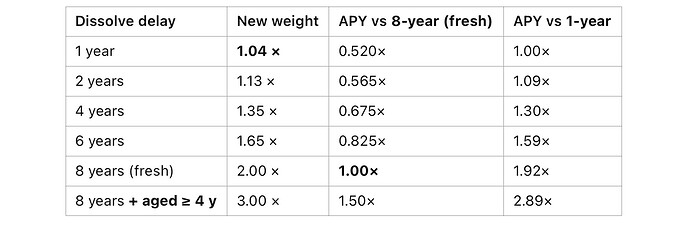

This has nothing at all to do with the discussion. The rate today of 8 yr neuron is totally fine. As is its decrease slowly. Whats not fine is that the 6 mo neuron has more than half of the rate, while having 1/16th the risk. Also the fact that the same 1/16th risk gets the same age max age bonus as an 8 yr neuron is simply illogical. The max age bonus for 6mo neurons should be 1/16th of the max age bonus of the 8 yr neuron (in accordance with risk), and the APY of the 6mo neuron should be no more than 1/4 of the 8 yr neuron, preferably less. Why does it make sense for basically no risk to make such a high reward compared to high risk?

The NNS structure clearly disincentivizes 8 yr steaking right now and thats fundamentally wrong.

I’d be game to have my maturity get a one way ticket into fueling something like my own personal apps rather than minting it into icp then using for cycles. Like I’d be okay with being my own “cycle faucet” basically, and I’d just turn on the water and leave it on… you could call me WaterNeuron #toosoon? #hashtag #imnotkiddingletmemovematuirtystraighttocycles

I agree. This has been discussed many times over the last 4 years. We studied it extensively in 2021.

DFINITY also proposed an improvement in 2022 as a mechanism to motivate more staking, but the community rejected it.

https://dashboard.internetcomputeruu.org/proposal/82963

These discussions pop up every year and always come down to people not wanting to make tokenomics changes. One thing that is different this time is that all seed investors have had time to fully dissolve if they wanted. However, many of the most vocal critics of tokenomics changes are still around and are likely to raise concerns if it gains traction again. Personally, I think the rewards for min dissolve delay is too large relative to the rewards for the max dissolve delay and would like to see an adjustment.

If you want people to take this proposal seriously, then you need to define specific changes and a concrete action plan for execution. The referenced proposals are good examples.

You clearly hide the fact that people ( you ? ) agreed to make the change to increasing the reward for 6 month neurons and that

Tried to stop those change from the beginning.

In the beginning it was proportional voting power and proportional reward linear with time. But you dont want that do you ?

What are you talking about? Are you completely clueless? There has been no increase in rewards for 6 mo neurons.

It still is…

I don’t get it. Didn’t I remove this comment ? Or perhaps you answered too fast

True decentralization requires aligning incentives across stakeholders, not just setting technical parameters. Without meaningful monetary or reputational incentives, dominant actors will default to behavior that maintains or enhances their control.

I suggest you all become part of ICP Mafia (but you have to pay the premium now :D) and help me adjust reward function bringing inflation down while benefiting all of us.

I think CEX will basically have to list WTN at some point.

They slept on this one - you still early. lol.

I don’t want our tokenomics to be like the rest of crypto though, we’re special… we have 8-years. We should only allow 8-year staking and nothing else. This exclusivity gives these elite stakers the privilege to participate in ICP governance. 8-year staking is like the initiation fee at a country club or business club, the $100k for initiation fee is money you will never see again, but I have the rights and privileges to vote on the clubs governance just like a $100k of ICP locked in an a 8-year neuron. These clubs are exclusive but not inclusive, there is a big price tag for inclusion, but ICP is diversified and for very little cost and a special 8-year commitment a psychological bond is formed allowing this ICP holder to feel they are part of something exclusive and that’s why we shouldn’t lower the staking to 30-days, we should only allow 8-year staking.

6 months (tourist ) Neurons should get half rewards of 1 year neuron or completely removed as option

Age bonus should be increased from 25% to 50% capped at 4 years -

If A neuron doesnt vote for 90 days on less <50% of the proposals age bonus should be removed (idle neuron slashed)

APY ratios proposal

Seen some great suggestions here but the one that sticks out is the short term stakers should be offered by DeFi projects.

People who don’t like to lock up for 8 years should not get voting rewards, this is for serious people believing in the long term future of Dfinity. Anything else are people chasing short term gains and should not stake in the NNS and get voting rewards. This will move some liquidity from the NNS into the DeFi degen corner and let the best project win… just my 2cents.

please, consider the following whale-coordination uncertainties when discussing this proposal as the ICP ecosystem consists of:

ICP-native whales → conservative, protocol-loyal, multi-year lockups (they see WTN as a threat to long-term sustainability)

WTN-maxi whales → short to mid-term yield-driven. Depend on high short term-yield (6 month neuron). Possible conflict of interest with core protocol direction.

Dual-stack whales (ICP + WTN) → opportunistic whales, balanced stance - like me.

Not sure why you reinvent the wheel. Ask AI the following:

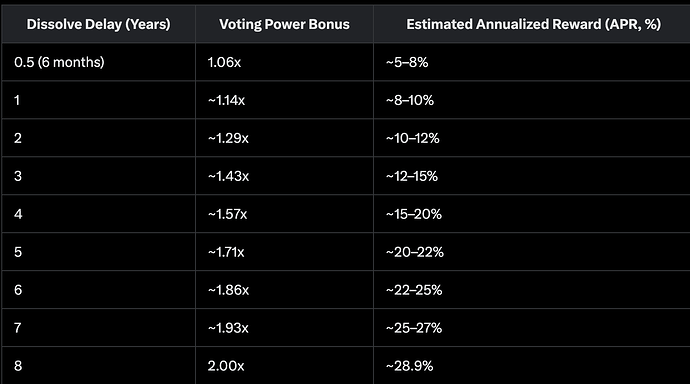

"What were the initial annualized reward percentages for each whole-year staking duration (0.5 to 8 years) for ICP neurons at the Internet Computer network’s public launch in May 2021? Provide a list with the dissolve delay and corresponding reward % (APR).+

Giving the following answer. This was the reward logic initiated by Dfinity before some self proclamed tokenomics guru decided to change it.

Lets just

Your AI is wrong. The 6 month neuron has always received approx 55% the APY as the 8 year neuron. Back in 2021 when the 8YG neuron was receiving 30% APY, the 6 mo neuron was receiving 16%. The primary reason it has dropped to the current 13.3% level for the 8YG and 7% for 6 mo is because ysyms and his whale backer abused the system with spam motion proposals. That’s the only messing with tokenomics that has actually occurred. Everything else has simply been discussion on ideas that have never been implemented.

You just blew my mind.

I guess I will learn to :

- source differently my informations

- not be so sure anymore about my memory ( because I was ! )

Thank you

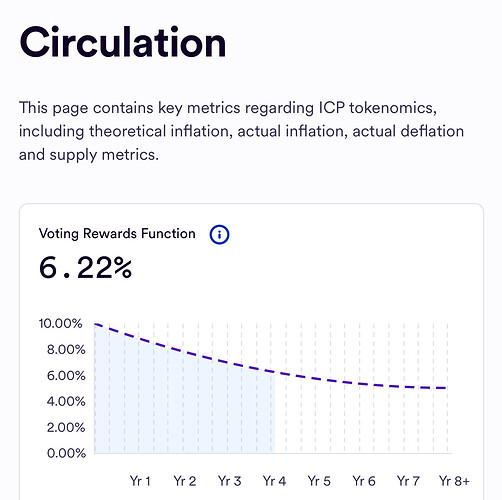

The APY decreased because the inflation rate was reduced from 10% to 6% — that has nothing to do with me.

You don’t get to conflate two separate concepts to shirk responsibility for your actions @ysyms. The voting reward rate curve is not the issue. Voting reward distribution used to divided proportional to voting power that votes, but the voting rewards are now divided proportional to voting power that is staked. We’ve never had 100 % participation in voting, so the APY of people who voted used to be much higher than the theoretical max shown on the dashboard (which assumes 100% voting). You and the whale who paid your bribes are fully responsible for this change that caused our voting reward to drop in half overnight. Everyone who was staking and voting in 2022 witnessed this drastic change, but perhaps they are not aware that your spam was the root cause. You were very proud of your spam back then. Why are you now afraid to acknowledge that you were responsible for the drastic changes that resulted from your actions? The root cause of the biggest source of APY drop between May 2021 and today falls squarely on your shoulders.

You are looking at governance like it is some exclusive club for people who prove their loyalty through long term lockups. That kind of thinking doesn’t work in real markets. This space is fast, competitive, and full of alternatives from an investment standpoint.

Polkadot pays nearly 14 percent with just a 28 day lock. Solana gives you 7 percent and lets you unstake in three days. ICP, with a 6 month lock, offers only around 6 percent. That’s a bad trade for most rational investors. The numbers don’t support the narrative.

If the goal is to attract real capital, you need to respect liquidity and flexibility. Pretending we are above competing with other chains does not change the fact that we are. Refusing to adapt makes the protocol and community look out of touch.

Telling people they need to lock their funds for 8 years to earn meaningful yield or have a voice just pushes them away. Most will not even bother arguing. They’ll just go where their money works harder for them.

But hey, we are in an exclusive.

I recommend that you get familiar with the sunk cost and narrative fallacy.

It’s unfortunate you feel that way @borovan, but you are wrong. I have skin in the game. I am genuinely trying to make the IC a success. I have a track record of positive and effective governance contribution. You may not like the fact that I’m willing to stand up to you, but you’ll just have to get over it.

You just described every centralized pump and dump out there… Oh my money is working harder there, lets go there.. oh wait, now it is worker harder, lets sell and go there… oh wait, now it is working much harder there, lets sell and go there…